Aussie real estate and lending risk

How healthy is @michwills CRV collateral in the current lending market?

What is Curve ($CRV)

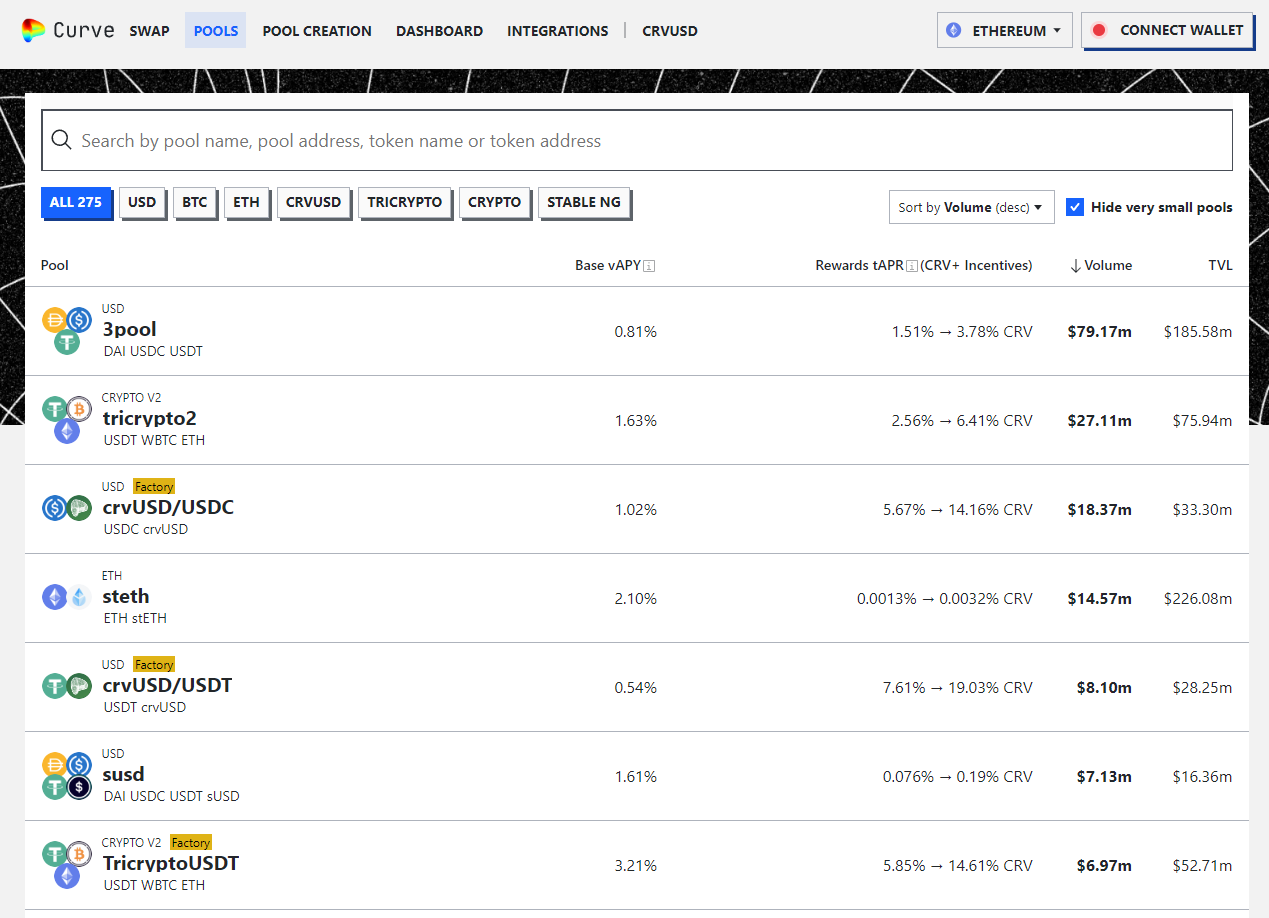

It’s important to understand the past to understand what could happen again. So lets start from the beginning, if your already familiar with crypto skip this part. Curve is founded by gigabrain math guy Michael Egorov. Its a decentralized exchange that started with basic swaps on stablecoins. It has since expanded to support other types of more volatile pools like ETH/WBTC/Defi tokens.

The token $CRV is used to vote on gauges which decide the rewards each pool will get every epoch. Users lock up their CRV for as many as 4 years to receive the highest voting power. It’s an inflationary token that is staked for voting and incentivizing liquidity pools. Now would I lock up a governance token for 4 years? no unless I somehow get tricked into snorting a bunch of glue. But people love to whip out the excel spreadsheet and start to extrapolate numbers. If I lock up $1,000 I will receive $200 every year sounds good right? Even with perpetual swaps which are derivate contracts on crypto that yield funding rates every day to normalize the swap price back to index people tend to get obsessed with cash flow. Whether its a defi token giving out an inflationary reward or longing / shorting a futures contract to receive your 9-5 wage cuck funding payment. People like it, hell sometimes I also put too much emphasis on it. 200% APR is cool in all if you don’t lose 80% of your principle…

Lending markets

So in decentralized finance Defi for short we have lending protocols. Users are able to deposit collateral and borrow against their positions. Decentralized and permissionless systems are great and all but they come with risk. When you allow token holders to set the collateral weights and what can be deposited this allows for potentially risky scenarios. Lets take CREAM finance for example.

Cream was a Compound finance fork where users could supply more exotic types of collateral that Aave and Compound didn’t accept. This incentivizes more users and deposits but also introduces risks. History taught us that certain collateral is very bad. After a governance vote Cream accepted SWAG token. SWAG token proceeded to go to 0 and it was very difficult for liquidators to step in to keep the system healthy. CREAM was left with 1.3m in bad debt and SWAG depositors prolly bought himself a nice apartment. Not to mention Alameda used CREAM heavily with tens of millions in FTX collateral. With decentralized systems, its not a question of if they will be abused but when.

So what happens next.

So as a founder its tough. You work very hard to create a project but how do you finally reward yourself? In crypto everything is transparent, except on solana nobody has a clue how to read the explorer. Cashing out is a very difficult problem in such a transparent system. One sell and every single community member hates you. So you have 2 options. The first is transfer tokens to a third party and just tell everyone “market making”, this is very popular and is a nice disguise. Now the 2nd option is more transparent but alleviates the sell pressure, yes thats right Lending Markets.

Now Mike starts talking to Kain and realizes he doesn’t have a reasonably sized house. For a founder this is very big problem, that must be dealt with in a decentralized manner ofc.

Mike needs to not only acquire the zombie punk of reasonably sized houses but also needs to one up Kain. Founders are competitive, they don’t become billionaires without the trait. So how does he accomplish this? Well he starts to deposit his CRV tokens in multiple lending markets. Mike owns 430 million tokens (roughly 50% of the circulating supply) and starts to scatter it out borrowing stablecoins ($USDC / $USDT) against the collateral.

Now this is all and well if the collateral value stays high. Unlucky for Mike, CRV suffers a $50 million dollar exploit and the token value starts to drop. People are now panic selling CRV and his collateral ratio across many lending protocols is falling.

I honestly had no idea the extent of how large this borrow position was and began looking at what the borrow rates were on his stables. Now keep in mind his on chain wallet had very little in stablecoins to pay off these loans. History tells us people often love to hunt positions, the “add fuel to the fire” saying. When a liquidation presents itself, the market usually locks in on the target. When you want to short something you usually want to find the trigger. What is going to cause this liquidation to happen?In this case it happened to be one of the lending markets safety mechanism.

The trigger 🧸🎯

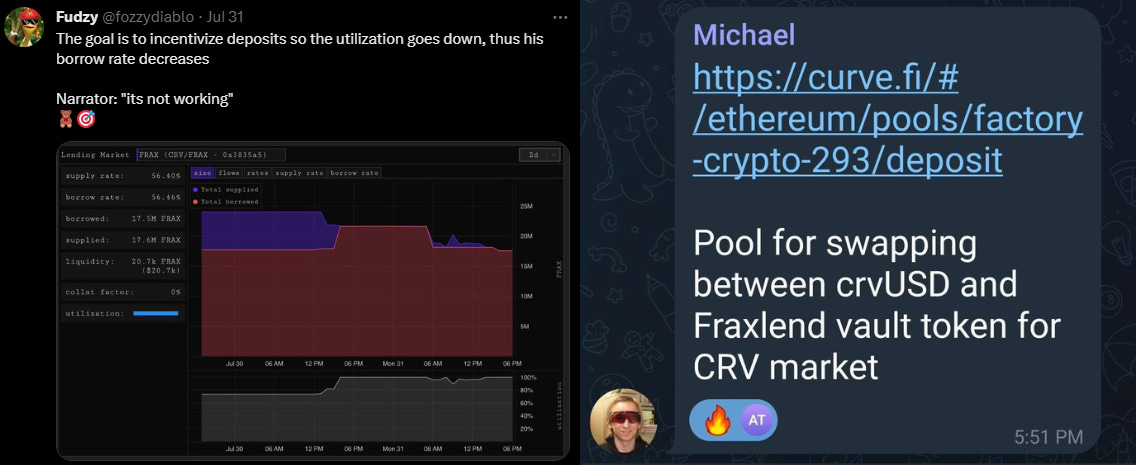

One of Mike’s lending positions was $17 million in FraxLend. Now props to the frax team they were aware of lending risk and had in place a mechanism that under different levels of utilization would alter the interest rate of the borrowed asset to incentivize the user to pay off their loans. In this case the CRV/Frax pool was under 100% utilization. This meant that every 4 hours that goes by at 100% utilization the interest rate would double. If Mike doesn’t pay this off, this is THE trigger. There is no escaping an exponentially increasing interest rate when you don’t have any money to pay off the loan.

Like we talked about crypto is transparent. You can track his wallet to see if there are any stable inflow. As long as there are no inbound stables this was free money to short. So I said screw it and levered up the short while monitoring his wallet. The position at the time was a ticking time bomb.

The borrow rate for his fraxlend position ends up hitting almost 70% annualized and still is at 100% utilization. Now Mike knows this is a problem, so he starts to borrow more from Aave and paying off the higher rates on his frax borrow.

Not only this but he creates a CRV gauge that has high APY rewards to increase deposits to the isolated pool he is borrowing from. The end result is lowering the utilization thus lowering the interest rate on his loans. Pretty genius tbh and quick thinking

With the high APY on this pool the cavalry arrives. Keep in mind, its a short term solution because the interest rate is still 70%. He has just prevented the growth of the rate.

OTC from above?

Does Mike have the money to pay off these loans. Ofc he does. But does he wanna spend US dollars to buyback his governance tokens. You can make a guess to that answer. The end result of this was a couple of OTC transactions from many counterparties buying CRV from Mike at a discount to the market price. “Handshake” agreements were that they were to be locked up for a couple months…at least this is what twitter was told. CRV rallies, and Mike sits comfy in his $40 million dollar mansion and played everyone like a fiddle. If you want decentralized lending markets this is what you get. It never should have gotten to this point, and many lending protocols scrambled to protect their user deposits by putting pressure on the CRV positions they had. Chainlinkgod sums it up nicely. GG Mike, well played

Will history repeat itself?

Why did I make you read a couple paragraphs on stroking myself off to the only money I made this year? Well, because as the old saying goes…Risk doesn’t disappear, you just move it around. Not sure if its actually a saying but it sounds kinda smart. As it stands now Mike decides to increase crvUSD (curve stablecoin) aum, by borrowing it on new lending markets with CRV as collateral. Fraxlend position still exists and aave position has been greatly reduced. These are the updated positions from largest to smallest. Rough liquidation for all positions is around 0.36 which is roughly -45% from current CRV price $0.68

CRV has heavily underperformed ETH, and everyone seems to be abandoning el herium.

Seems safu what gives?

When I am not exit liquidity on shitcoins I find myself looking for shorts that if the market turns they will face forced selling pressure ( Luna good example of this). People like use the fancy word high convexity and it happens to work both ways. TLDR when it starts to move it MOVES hard, at least I think thats what it means. Now remember the safety mechanism fraxlend had that forced Mike’s hand. Well Silo, his largest position has almost the exact same mechanism.

Currently, its safe sitting below optimal. While still having a high interest rate on the borrow 33.5%. So whats the kicker? Let me introduce you another main character Sifu. It’s important to know who is proving Mike with the ability to borrow. In this case we can see the depositors of crvUSD in the isolated CRV Silo pool. Sifu has 20% of the pool representing 12m of the 60m.

Why is this important? Because Sifu can single handedly withdraw his funds and push utilization past 90% kicking the interest rate into growth mode. Now why would someone do that if they are getting 25% on their 12m deposit? Well, without other market participants depositing crvUSD into the pool Sifu could short crv pull his deposit and really put the pressure on Mike.

So as long as Sifu can withdraw before CRV falls and utilization gets maxed out he is successful able to play both sides of this trade. Has the ability to control the interest rate which puts pressure on Mike with a short on his collateral, but also gets ~20% on his deposit.

What next?

Mike will continue to incentivize the silo deposit pool, to minimize the growth of the interest rates. But currently his debt grows at almost 1m a month. There is no other lender that will support his collateral this time around if things start to go south. He is backed into a corner with his 2 largest positions having mechanisms that exponentially growth interest rates when things go bad (Silo, Fraxlend). This is such a doomsday overhang that sits over CRV. I believe his debt will grow at a pace greater than his CRV collateral in 2024 and it all ends in tears for most veLOCKOOOOORRSSSS.

Fade me, bet with me, do what you want. I’m just trying to provide some context of the risks holding CRV, and nobody seems to be betting on it.

Remember if im right I make a bunch of money, if im wrong this was all psyops…

Happy New Year

-Fudz

Edit 1/8/24

Situation is actually worse than I thought and I completely missed more loans Mike has. Total Deposits in SILO are over 124m and borrows are 51m. So in total we are looking at around 80m in borrows.

Not great