math aint mathing

prediction markets are fun

While the market bleeds out gambling on random predictions has been addicting. With the upcoming election there has been alot of buzz around polymarket and other types of political wagers. While prediction markets are often cyclical around politics and even sportsbooks around NFL season, I expect the full on gambling trend to continue. If we are betting millions on trump saying tampon today, who knows what we will bet on in 5 years.

So how do you make money? I have no idea how political polling works and shit I don’t even understand the electoral college. So I try to stay away from politics. I’ve found the easiest money on polymarket is made when FAKE NEWS gets tweeted out and people instantly market buy or sell based on this.

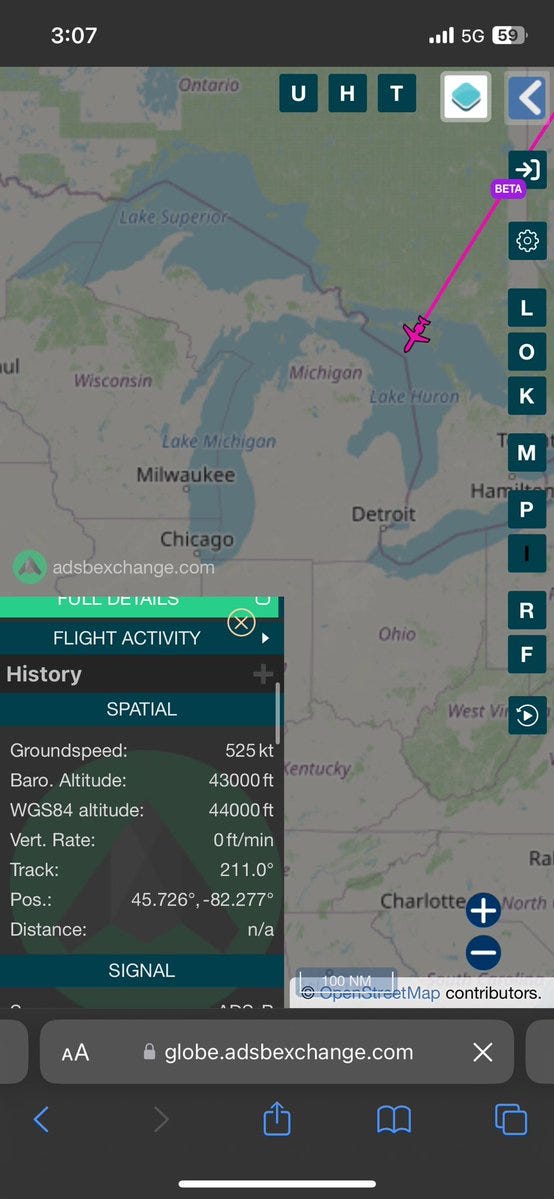

A good example of this was Elon being a guest speaker at the Bitcoin conference. The night before was the opening ceremony of the Olympics and he was partying in paris. Larah loomer or whatever her name is tweets out elons jet is headed to nashville for the conference to appear as the “special guest”. Aircrafts are all trackable if they are flying IFR and have a flight plane in place. So bitcoin influencers and trumpooors start tweeting that Elon is inbound.

The above tweet was enough to move the market by tens of thousands of dollars in a range of 20-30 cents. Its hilarious you have a plane miles out from nashville at prolly 40 thousand feet yet this is enough for people to take a 50% wager elon will show up. First of all elon doesnt give a shit about crypto. Elon only acts in his own personal benefit…always has…always will. Second of all you have to think what other places could he be flying to. It turns out that he has a super computer in memphis. This was enough for me to place some bids around 40-50 cents. Am I gambling sure, but fading btc influencers and trump tweetooors is prolly a winning strategy. How much thought did I put into this? not much. Is this a sound strategy in the future? prolly not

Now that we are plane tracking experts lets take a look at another market.

Will Taylor Swift attend the DNC in person?

So the whole point of these is to get better at thinking about predictions. Trying to fine tune this degenerate process can be tough and most likely losing money is the only way to improve.

At first I start thinking of a couple things

Taylor Swift has supported the Democratic Party in the past

Often multiple musical performances at political conventions

DNC starts August 19th-22nd

Taylor swift has a concert in London until the 20th

Do the biggest musical names perform on the first night?

London to Chicago flight time

Track the private jet

At this point taking no under 90 cents felt like good value for a bet expiring in less than a week. So I start bidding collecting my $2.50 in rewards daily. First Day of DNC happens and no new news from taylor swift related to DNC on twitter. Market starts trading into the 94-96 cent range.

THEN BOOM her private jet takes off from London and appears over Canada

At this point there is a slight panic and start asking myself if the timing makes sense. Can she get there before the 2nd day of the DNC begins, yes. SHit, doesnt look great so I begin trying to sell. I ask my quant what he thinks and he sends me this photo.

o fuck is right. thats the best TA if ive ever seen one. But then I realize im making the same mistake as the Elon BTC conference people. Just because a jet is in the vicinity or looks like it could land is that enough to wager? In this case 10-1 maybe, in elons 60/40 of course not.

So now im trying to think of every destination / flight path. Where does taylor swift travel after concerts? Most of the time its a flight back to Nashville but heres the thing that flight path doesnt match up at all with London to Nashville in fact its not even close.

Then my quant sends me this

This might make more sense, Swift is dating travis kelce and there is a preseason game that day. Travis isn’t even playing and why would she give a shit about pre season football idk. At this point im lost, market is trading at 8 cents for YES and im not confident enough to send it. Asked some people and there was a crucial part that I missed.

Yep, weather. Even though jets fly at like 40k feet, you gota ensure the smoothest flight path for her excellency dont you? With this information I decided it was enough to buy NO again. About an hour later her jet is at 43k feet and not landing in Chicago and headed straight for Nashville.

So thats the end right, we made money? When in doubt there is always a sweat. Of course on the final day of the DNC we start seeing twitter pick up on a random picture of a private jet that flew from Nashville to Chicago and the market pumps to 13-15 cents YES. There seems to be a common trend here and I always seem to be fading pictures of random Jets at airports tied to celebrities. We doubled down NO and watched the girl from SNL perform on the final day instead of taylor swift.

Is there a ton of money in prediction markets? no

Is it fun to figure out obscure bets? i guess

Is this a complete waste of time? prolly

Now that I think I have somewhat of a decent decision tree for these types of obscure markets we bring ourselves to the final boss

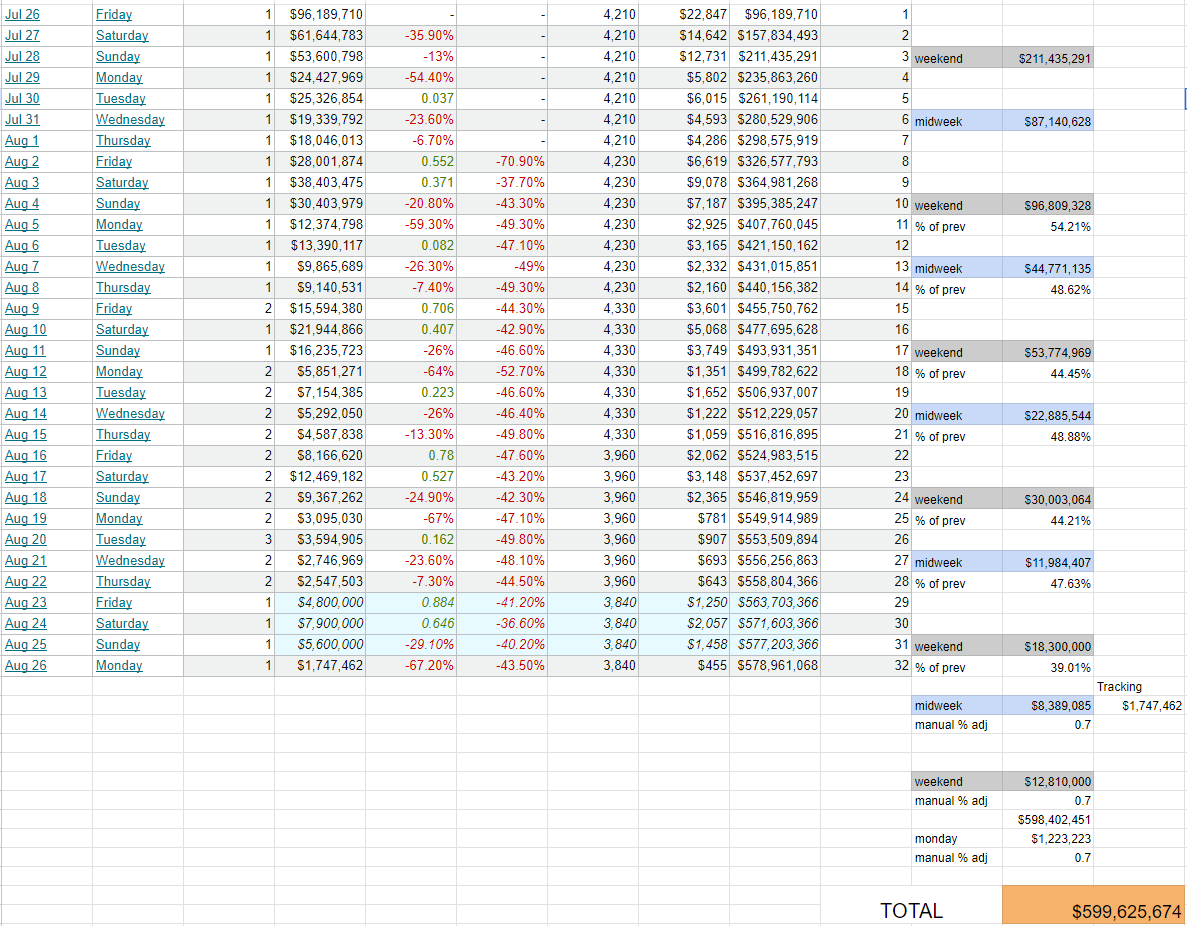

Deadpool domestic box office sales sit at $578,961,068 as of today pending tuesday sales. Napkin math we need 21m by labor day weekend for YES.

Alright so here we go again, how do you try and figure this out. Lets just take the daily numbers and put it into google sheets

then lets group them by midweek and weekend. We can see that weekend numbers decline anywhere from 54% to 40% and midweek is pretty steady at 48%.

So lets just throw out some numbers, 40% of weekend / 40% of week / 40% of monday

annnnddd we get $596,422,487

alright im no genius but thats below 600m so why is YES trading at 84 cents?

In fact lets say there is only a 30% decline

annnnddd we get $599,625,674

again still no genius but thats also below 600m

so what am I missing?

Monday is a holiday so if it does normal holiday numbers plus weekend and weekday at 30% decline it will > 600m. This is a big IF

First thoughts are labor day movie sales are higher? But every google journalist thread and report says labor day isn’t even a big movie weekend. Alright just like in the swift to DNC I missed the weather. When its raining people might go to the movies right?

Now we need to figure out which states put up the biggest numbers.

Alright interesting so Texas Georgia and Florida might be shit weather which could drive larger turn out at the box office. Alright what else?

There are no other big movie releases which might drive sales down, thats good for number go up. Google trends seems to be down only? Is there some insane marketing push for labor day weekend? idk doubt it

WHY IS YES AT 84 CENTS???????

The largest holder is Decap, which according to most people is either retarded or a genius. Its always important to know your counterparty

So I asked

My math isn’t the craziest equation, its pretty simple. But how can his math be so different. Is decap a math wizard? Does being a math genius even help you in this case?

We are not talking 50/50 here we are talking 84/16

again, what am I missing?

and here in lies the mental illness? Have you found value or are you really just an idiot?

Am I betting my life savings on whether it rains in florida or not?

-fozzy

Can't get this thought out of my head; what's the ultimate randomness without room for alpha via research? A provably fair coin toss. Presumably, the opposing predictions will reflexively provide an EV = 0 ( *assume liquidity). Well, what's the point? Now assume an algo running a modified martingale that resets to initial bet after each win. Gambler's fallacy, I know. But, now assume (stay w/ me, plz) an on chain insurance against market risk , that collects premiums, & pays out after x # of Ls. *If the parameters for payout can find a sweet spot, this *could be a perpetual payout machine. Whut? Wait! That's a ponzi. Maybe. Maybe not. No one-handed economists around these parts. If so, it's a transparent, equitable, and, *potentially sustainable one; that's more than can be said for Uncle Sam's sh*tcoin. (But, El Presidente Trumpo is working on a solution, no worries. Seriously. Don't worry). If this (my idea, not Trump's) got a little traction on TrueMarkets ( recent upstarts make sense as it could be their ticket to leapfrog incumbents) the insurance {against market risk} protocol could be expanded to cover risks in sports betting, crypto day trading, uber-degen InfinityPools ( unlimited leverage ); heck there's a leveraged sports betting web 3 project ( InfinityPools + BetDex = LEVR). Just scratching the surface here. Am I crazy? Yes. But, these days we see crazy & right walking in unison.