[old] Axie Infinity - What goes up must come down

A walkthrough of Axie Infinity. A new game-fi play-to-earn mechanism and its flaws

What if I told you could arb 20%-30% with a 5 day carry with 30m in daily liquidity or yield farm at 200% yield…

At first glance Axie Infinity looks like a harmless simple click and drag game with a combat system a 4 year old could master but under the hood its a brilliantly designed economic machine that will churn to the constant demand of what I like to call “GDP Arbitrage”. In todays ramblings I will try to cover…

The Axie ecosystem as a whole

The Axie flywheel Breed / Burn / Scholar / New Players

Breeding Margins

Some trade ideas ( Fozzy Yolo )

Overview

Axie Infinity is a Pokémon-inspired universe where anyone can earn tokens through skilled gameplay and contributions to the ecosystem. Players can battle, collect, raise, and build a land-based kingdom for their pets.>

AXS Governance Token

AXS is the Axie governance token that represents according to them future earnings that come from Axie Treasury. Only way to currently earn AXS is from placing top 500 in arena. Future ways might include staking, Ronin DEX LP incentives, and who knows the hell knows. AXS is sent to treasury after users breed their Axies.

SLP

SLP is the token rewarded from winning adventure and arena mode. This is the main focus of the play-to-earn concept where players can sell SLP for real money / other cryptos. SLP is also sent to treasury after users breed their Axies

Ronin Side Chain

Ronin chain is a EVM compatible fork of ethereum. In order to participate in the Axie ecosystem you need to bridge your funds from Ethereum. From there all activity from marketplace / transfers / breeding all take place on the Ronin chain which is free up to 100 tx a day. None of the gameplay is recorded on chain.

Scholarships / GDP Arb

Scholarships are the lending of Axie teams to other people who play with your assets. You then split the rewards between the manager (you) and the scholar. The manager has full control of the wallet that holds the Axies so there is no risk in the scholarship program from a custody perspective. This greatly boosted the Axie community because people in poorer countries can benefit from the income as well as the managers can benefit from the yield. For example average annual salary in the Philippines is ~ 10k and if someone with some spare time and an android phone can make couple hundred dollars every week thats awesome.

Starting Out

A first time user has to purchase 3 Axies to start playing the game. Then you use your team to either play adventure mode (vs computer) or arena mode (vs another player) to earn SLP which is a crypto you can trade on AMMs / CEX. Each mode uses up energy which is constantly refreshed depending on how many Axies you have on your account, the more axies you have the faster the refresh rate.

So lets say you buy a team ~$550 and decide you want to play a card game for 4-6 hours a day. The average player earns roughly 120 SLP which is 50 from adventure, 25 for completing the daily quest, and the rest comes from arena wins. Currently SLP price is $0.112 so you can earn roughly $14 a day with if current prices hold and ~$550/$14 ~40 days until you have recouped your initial investment (This of course is subject to the price of SLP which we will get into later) So why isn’t SLP on a downward spiral to 0 with this constant inflation pressure?

Enter Breeding

The cost to breed 2 Axies is a fixed fee of 2 AXS and (150+150) 300 SLP if both Axies are virgins. The more these lovebirds hop in the bed the more costly it gets as the SLP cost increases by 150 each time up to the breed limit of 7. The offspring takes 5 days to hatch and will inherit traits from both parents in a Dominant / Recessive 1 / Recessive 2 structure with a 5% mutation rate for each gene. Sorry bible belt, there is no incest in Axie Infinity. As long as the 2 Axie’s share a common family tree they are unable to breed. The goal of the Axie team is to act as the “FED” to monitor the breeding (burn) and minting (inflation) of SLP.

As of Aug-23 the price of AXS has skyrocketed so much they had to reduce the breeding fee from 4 originally to 2 now. At times it was currently unprofitable to breed most types of Axies. They also implemented a SLP reward change to shift the focus more towards arena and less towards adventure. This had a massive effect on the floor price Axies because ones with poor traits could still complete adventure and farm reasonable amounts of SLP. Now that arena is the main source of SLP rewards the Axies need to have good pvp traits. The change was to reduce the inflation of SLP but in my opinion it only made the net effect on SLP price worse because by shifting the focus more towards arena, floor axies which normally would be subpar arena traits could still be sold for decent value. This change decimated the floor price of Axies which resulted in breeding becoming less profitable.

If the breeding stops there is no burn –> no burn –> SLP goes down –> scholars make less money –> less breeding.

Tail wagging the dog?

As the saying goes is the dog wagging its tail or is the tail wagging the dog. In this case we must ask ourselves is Axie demand driving the price of SLP, or is SLP driving the demand for breeding. I’m leaning more towards SLP driving the demand for breeding because of how reflexive this asset is. Lets dig in…

What is a reflexive asset?

Great pieces from Deribit Insights if your unfamiliar Pt 1 Pt 2

So how the hell did this happen?

It all begins in a time where DEFI yields are getting absolutely pummeled mid summer-2021 and nobody knows where to put there money. When people are starving they are pushed out further out on the risk curve. For us non VCs this actually involves risk.

The narrative had shifted away from DEFI and towards NFTs again. Axie was directly in the crossfire and benefited greatly from the media / CT exposure. People saw oh look I can pay X amount for a team and generate 200% returns with the scholarship program. Aave is giving me 3% on my USDC, sure why the hell not. So boom, we get massive demand for Axie buying and scholarships. But then people dig a little further and realize they can make 20-30% margins just breeding. This perpetual cycle started churning very fast as people realized how much money there was to be made.

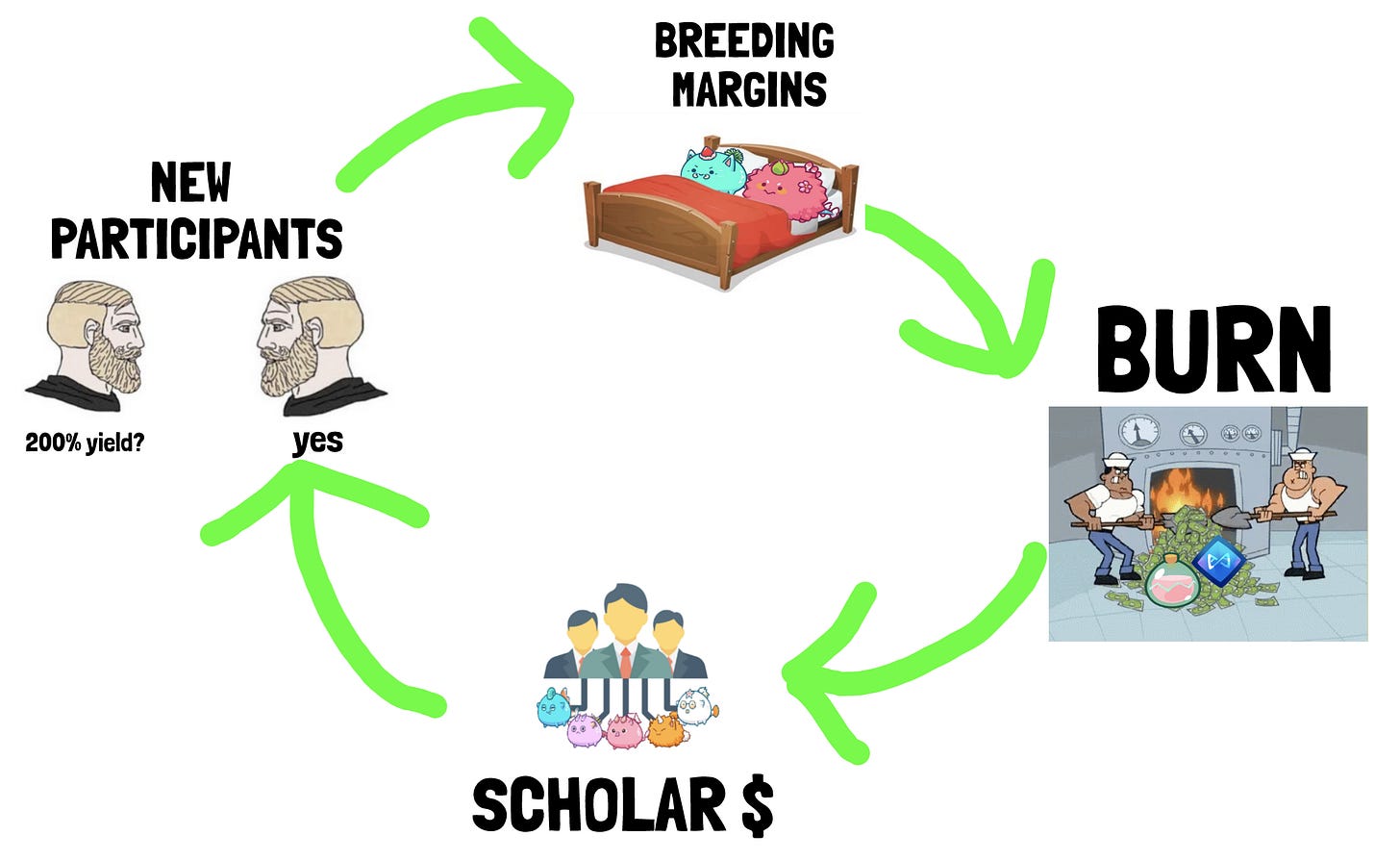

Where does this cycle start we might as well ask the Tootsie Pop Owl. It flows like this…

New Participants

As new players enter the system they need to purchase at least 3 Axies. This creates the initial market demand.

Breeding Margins

With more Axie demand, it becomes more profitable to breed Axies

Burn

As more Axies are bred, this burns AXS / SLP which can create significant buying pressure on both assets.

Scholar $

If SLP appreciates this means that Scholar’s will make more money from playing Axie.

New Participants

More money for scholars means higher yield for managers which creates demand for new players to enter the ecosystem.

So at this point you should realize this creates the ultimate reflexive ponzi with a 5 day lockup built in. Not to mention funding early on was insanely negative on the AXS perps which made up for most of the volume.

Crypto Twitter seems to love protocol revenue for some stupid reason and this Axie ponzi absolutely prints because of the incredible flywheel Breed / Burn / Scholar / New Players. Heres the thing, they seem to denominate the revenue in USD yet it mostly comes from AXS deposits in treasury due to breeding. So what happens, maybe just maybe -tinfoil hat on- some funds / whales notice that if they start squeezing this thing it becomes a massive catalyst to bootstrap the revenue shills and Axie flywheel. As AXS price goes, higher the revenue goes, more eyes on axie, more axie demand, more burn, more money for scholars. Ahh at last the self sustaining economy Mac dreamed of.

Fozzy Yolo

Welcome to the fun stuff. Hopefully by now you have learned how the ecosystem operates and how the tokenomics are designed. Now for the disclaimer, I got absolutely dummied holding a short in the most recent AXS pump because of coinbase insiders ( thanks guys ). But its a lesson and a catalyst I should have honestly seen coming, you live and you learn right. I will now go over 2 strategies for Axie I believe are strong plays…

Closed Ecosystem you say?

Since Ronin is a side chain we can track all the activity coming to and from this Axie ecosystem with a Dune Dashboard

As we can see this is ETH deposits to and from the bridge. You can really see the insane breeding demand that occured in the June - July boom. This was due to insane breeding margins as people were churning 20-30% premium in 5 day intervals. An easy way to track breeding is to look at AXS deposits because currently there is no reason to send AXS to Ronin unless you are breeding. As you would expect these are highly correlated. New players are bridging over ETH to begin their Axie journey and existing breeders are taking ETH out to buy AXS and SLP to continue their mass Axie orgies.

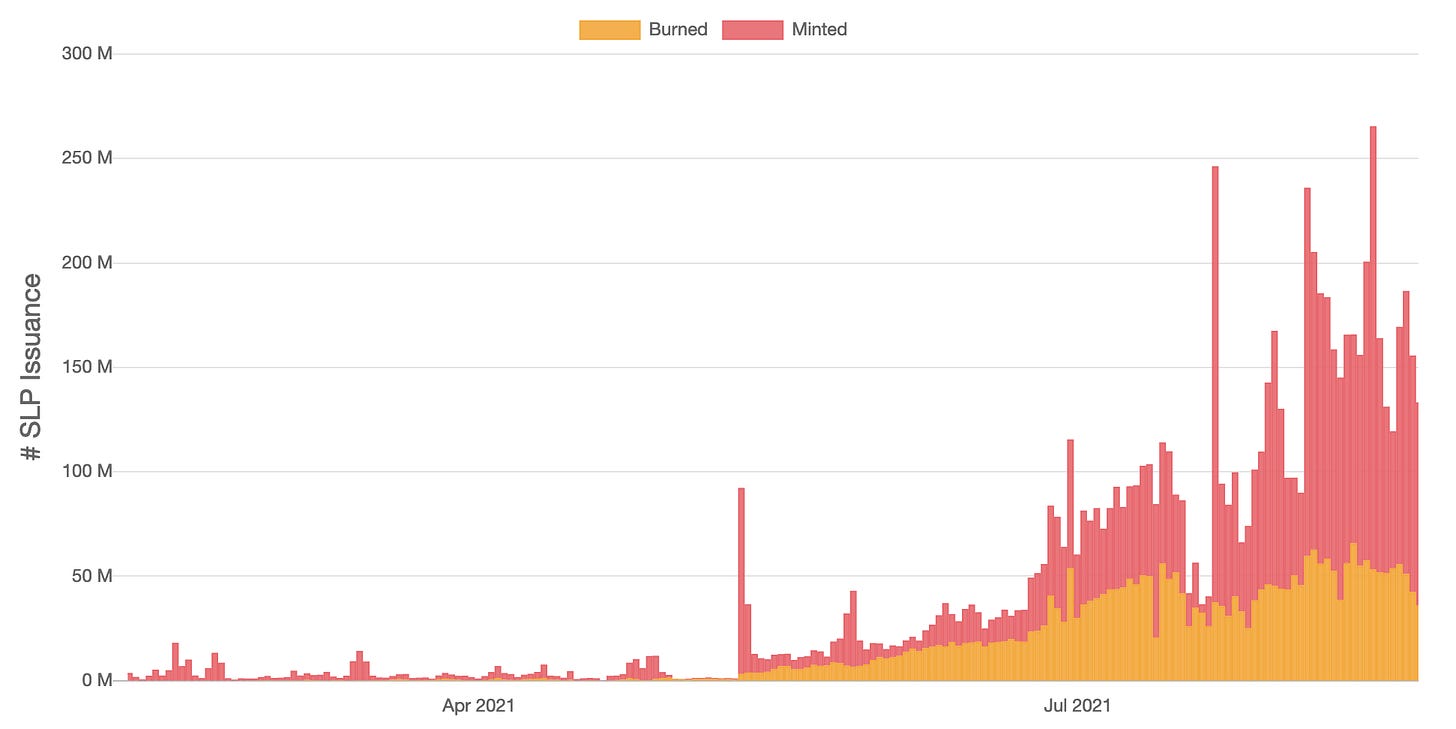

Above we can see SLP deposits and withdrawals in strong correlation with AXS deposits. You can notice that the deposit / withdraw balance was net positive deposits in the run up. This is a good thing which means the ecosystem was very healthy and balanced. Right near July 24th we can see the balance start shifting towards net negative deposits from the ecosystem. Because the marketplace is denominated in ETH as you can see from the chart below these are all connected. The marketplace doesn’t seem to adjust itself very quickly and is very sticky to ETH pricing where it really should be adjusting itself to USD priced demand.

So what is happening?

When an Axie is breed it “burns” 2 AXS and 300 SLP, but that Axie if used is perpetually minting SLP. New ETH deposits needs to increase exponentially to keep up with the perpetual output of SLP rewards. As the charts show this is not the case. ETH deposits are falling while SLP withdraws are almost off the charts at this point. This ugly unwind has been damped a bit by ETH going up because the marketplace / breeders gets a boost in USD appreciation. Why do you think FTX listed SLP-PERP. I can’t tell you its not because of the volume / fees.

If you were to choose your fighter would you pick…….

Twitter traders who pick up a crayon and draw a falling wedge?

Math wizards from Alameda?

I don’t have access to futures?

At this point in time it is hard to determine how much an Axie scholar will make over the next 6-12 months due to the uncertainty of SLP, so the next logical step is to look towards breeding. Since breeding costs are fixed, you want to look for the highest margin traits. This can be done by scanning the marketplace by traits and determining relative “floors”. 6/6 pure Axies mean they have all 6 traits the same class. This gives them an extra boost in stats and they are desirable. Axies with every single traits from Dominant / Recessive 1 / Recessive 2 all the same are very rare and fetch a fat premium.

So the focus in terms of margin is on these Axies. You can run scripts based on traits to see how efficient the marketplace is. If you are able to determine you can buy Axie X and Axie Y and sell their offspring for a profit based on trait probability you could churn a nice little business. You can estimate your breeding offspring margin based on floors. Now this is all subject to change because there is also a 5 day hatching period but this is in my opinion the safest way to approach this ecosystem.

Conclusion

Axie is a cool concept and its a great start for blockchain gaming. They realized early on they needed to get off Ethereum because of the high fees in order to gain any major adoption. Don’t get me wrong I am all for creating new ways for people to make money especially those who are unable to get jobs due to certain circumstances, but people seem to forget that the money has to come from somewhere.

In order for “Play to Earn” to become sustainable you need to constantly create new demand. Every game ever created has had to deal with inflation from in game currencies and there are many ways to deal with this. Axie will need to get very creative in creating new burn opportunities because demand comes from the money you can make not the gameplay itself. A couple ways they can approach this…

Land mechanics

Items

Axie upgrade / burns

Pay for ronin transactions with SLP (not even sure if possible)

Host many tournaments with SLP ticket entries

Host a ranked arena where competitors play for AXS they stake, again SLP ticket entries

Axie will survive no doubt, but they have a very steep uphill battle. I think its more of a financial adventure than enjoyable game for most but that wont stop the concept of GDP Arb being gamified into these colorful pets.

If you have somehow scrolled this far I hope you can see whats happening as this ecosystem starts to unwind. As I have mentioned the recent appreciation of ETH has provided some what of a buffer and if that goes….God have mercy.

Reflexivity is a beautiful thing. But the same ponzinomics that pump it up also can send it right back down in a very ugly manner.

Has the music stopped for Axie?

-@fozzydiablo

Best place to trade = FTX Exchange