Saylor has crossed the Rubicon

Microstrategys impact on the market, and eventual doom

Did you know a dunkins iced coffee is almost $5. I remember riding my bike to mcdonalds with a couple bucks in my pocket and felt like I could feed a village. How did we get here and whats to come from my macro outlook? who cares, macro is bullshit and anyone trying to understand orange man is doomed to fail. As a friend once said,

Can we continue to guess how the market will react with tariffs, doubtful tbh. Most will take a long view praying everything will revert and it could be correct but are there better trades?

Since December I’ve taken the view majors have topped and will either stall or bleed out but Saylor will provide enough of a twap that BTC dominance will outperform. So far that has held true, so I got that going for me. However holding these positions where your long bitcoin and short a basket of some alts & other majors can be risky when there is a large vol event that shifts the vibe. An example of this would be the presidential election. A binary event that shifts the market in such a big way you can see alts which might have alot of short interest exposure squeeze. This is usually where I get rekt and tbh I did when trump got elected. I thought Trump would win but I believed it was going to be more contested and alot of the Trump OI would get washed out before the presidency was finalized. Great story man, nobody cares! Now how do we make money…

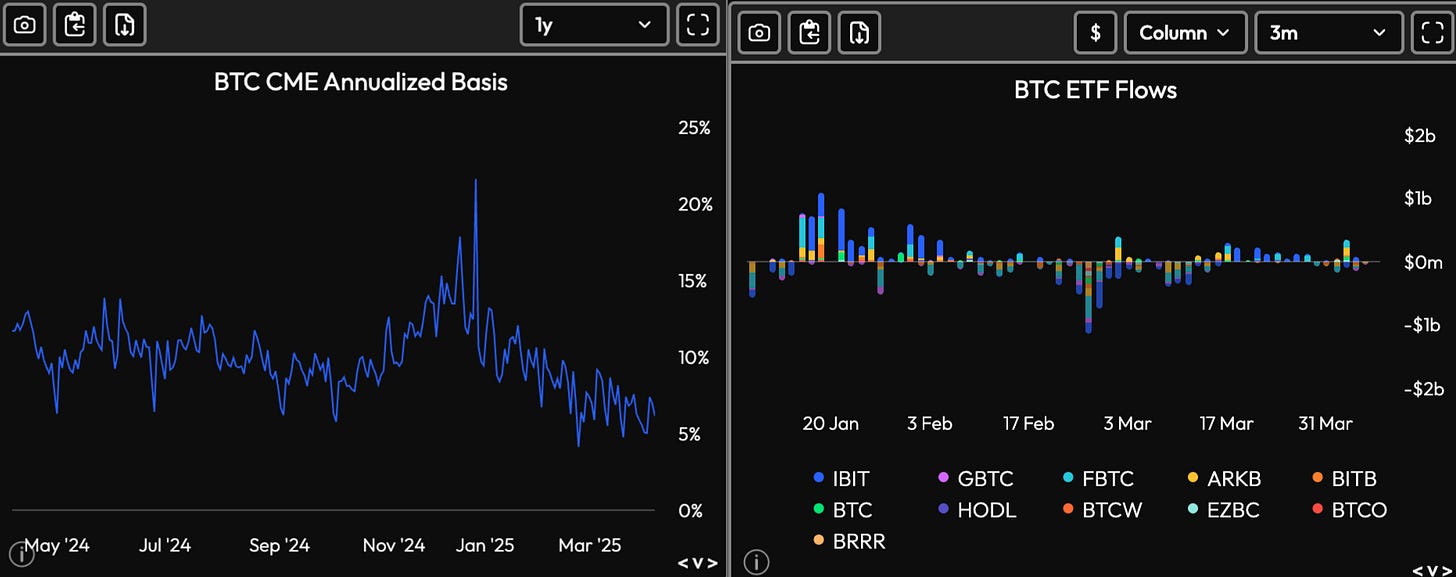

Alright most of my thinking for the last 5-6 months has been that Saylor is the entire market. Saylors buying combined with large institutional interest post trump election did a couple of things. One tradfi apes pushed CME premium for futures up to >20%. When this happens the basis trade (buy spot / sell futures) becomes very attractive. And ever since the ETF this trade can be done more efficiently. Most of the ETF inflows were harvesting this yield. Now the important part is when the basis gets put on I believe it has a net positive impact on price as sourcing the spot BTC is harder more illiquid than selling a future.

Having said that, ever since saylor blew his load at the top his buying has been exit liquidity for this basis unwind. When said position has to exit it creates a downward price impact as selling spot BTC is worse than buying back the future. Basis premium and ETF flows work together.

So how is Saylor able to raise so much in debt? Well the twitter macro stat arb credit gurus GMO free traders would argue its because of the underlying volatility of MSTR stock. When you buy a convertible bond your essentially buying a call option. Saylor was giving out in a relative sense a very cheap call option relative to the market. While the vol 4 years out is less than the front contracts I guess these guys sensed value? Below is a bloomberg terminal screenshot to make me look smarter.

Now I know absolutely nothing about this space and maybe there are markets that exist where they can purely arbitrage these values 4 years out. If you pull up a terminal you can see some of the top holders are short MSTR equity but there are so few listed buyers of the bonds its hard to say where the actual demand comes from. Its hard to say for sure how the buyers valued it but whats important is how Saylors ability to raise has changed. When volatility was very high he was able to raise debt but as the vol collapsed his ability to raise more debt has come into question.

Its very important to understand the premium. Because not only can saylor try and issue debt but he announced of the biggest equity + fixed income offerings in history. A 42 billion capital plan he called it. Saylor is no dummy, if his equity is trading at a premium why let traders feast on this when he can take advantage of it himself. So thats what he does, the goal is to sell as much stock as possible to fund bitcoin purchases. This works until the premium starts collapsing too much. The premium got as high as 3.4x which means their companies MCAP / BTC holdings. Nobody gives a shit about their “software business”, most likely employees random friends & family. Saylor ends up twaping all this down to currently 1.7x.

Since announcing his common ATM he has sold almost 19 Billion dollars worth of stock to buy bitcoin. I swear most of you don’t realize how much buying power that was relative to the market. Now this works until he starts to piss off his cult too much. When the premium dropped to 1.2 reddit/r/mstr starts wondering if they are all retarded (they are) he had to come up with other options. Back to debt right? well since the vol collapsed he really had to sweeten the deal and he did.

So this was enough to stop the premium collapsing and took some pressure off the stock. But unfortunately equities and orange man had another thing in mind. Debt markets seem to have the advantage at the table so he needed to invent new products to attract new buyers, welcome RETAIL! Enter STRK and STRF which are preferred products that your average couch dwelling robinhood user has access to. Smart people wont give me cheap money, might as well try the american public.

Dividend Yield: STRK offers 8%, while STRF provides 10%, reflecting STRF’s higher income focus and lack of equity upside.

Conversion: STRK can convert to MSTR shares, offering potential capital appreciation, whereas STRF cannot, making it a fixed-income-only play.

Risk Profile: STRK has more upside potential (and risk) due to its conversion feature, while STRF is more stable but lacks growth potential beyond the dividend.

Investor Type: STRK suits those comfortable with some volatility and bullish on Bitcoin/MSTR, while STRF appeals to conservative investors prioritizing steady income.

Remember before all this debt was mostly raised near 0% rates, but now he is willing to pay 8-10% to keep the twap alive. And even filed an ATM offering to sell the STRK (issued at 80 cents) which has done very little volume as he tries to sell it.

So as it stands now he has 3 options

Sell ATM stock (easy to do but kills premium)

Sell STRK (still too expensive, zero demand)

Issue more debt (if there was demand, he would have done this already)

debt would give him ammo to hopefully kickstart the premium again and vol

So if we apply some probability to those options find some pen and a spare napkin how much buying power do you predict will come from saylor in the next 3 months? Nobody has a crystal ball but I estimate we see under 3b of buying and this is using up all the common ATM 2B, and 500m maybe from STRK. Currently MSTR has 528,185 BTC and the current poly odds look like this

The June market only has 3k volume so don’t pay too much attention to that but May market would suggest Saylor needs to purchase ~22k BTC which at 80k BTC is 1.8B. Thinking about it more 30% is way to high id put it at 15% idk.

What i’m trying to say is MSTR financial alchemy used to work because the amount he was buying was so meaningful to the price. It was hard to source BTC and the illiquidity worked in his favor. But now things are different. The ETFs have a shit load of BTC easily tradeable and it takes 10s of billions to really move this thing. Bitcoin is boring, and without vol it becomes less of an attractive asset.

So making the assumption saylor is unable to generate the vol needed to bootstrap the ponzi again we have an easy trade. Just short ETH. Only joking, but maybe.

The trade?

Saylor assuming average premium of 1.5 and an avg BTC purchase price of 67k, $200 MSTR price is roughly the breakeven. This is a very important price for saylor and last time it came close he forced to make a sweet deal for more debt. Saylor knows the average price is important and the moment it goes negative it will dominate every financial headline. “SAYLOR BUYS 42B OF BITCOIN NOW PNL NEGATIVE” idk something like that. It matters, and I can’t seem to understand why the consensus view is that it doesnt mean anything and only his liq price matters. BTC is a big enough market now where you have the professional trading firms foaming at the mouth with a large borrow spot market where the hunt becomes a possibility. Maybe I get off to these financial conspiracy trades? But id like to think this is a very profitable trade to put his position in the crosshairs.

So if we assume $200 MSTR is important. I have been selling the credit spreads 200/190 idk what the format is to say the position. Sell the $200 put buy the $190 put and short the spread. Is it boring ya, are options out of my wheelhouse for sure. But its a do or die spot for saylor and he will do anything to keep it going.

The other trade is staying short alts against BTC but with tariff headlines on the horizon like i talked about vol events earlier, its not worth it. Actually longing dogshit against short majors like eth is not a bad trade. Hopefully you get paid to wait and there will be enough vol whipsaw back and forth that the short interest will get carried out.

I wouldn’t put too much into these trades, the main focus of the blog is to show that saylor is struggling and doesnt produce the impact he once had. I firmly believe he is the only buyer and any other buying in size is because of saylor. This is why we get BTC dom up and ETHBTC to 0. Nobody buys majors outside of eth and if they do its to fund another salami ferrari.

Hopefully you enjoyed it, no real detailed analysis but just an overview of how I think about saylors impact.

Survive, cause this inevitably ends in tears

-fozzydiablo

I agree with your premises that (1) Saylor represented a big portion of the BTC market last year, and (2) his influence is waning. But you hastily assert some (incorrect) assumptions, like the fact that Saylor will be hunted -- the majority of MSTR loans are preferred equity so Saylor's effective liquidation price is stupidly low, like sub 10k, and there isn't a universe where you can justify the scale, cost, risk, and coordination required to successfully "hunt" BTC to this price, from 60k(?) BTC.

I also don't this necessarily implies that ~$200 MSTR is a price that Saylor will defend, like you acknowledge in the article his ability to raise is mostly dependent on MSTR volatility, not price. Moreover, you conclude that short alts long BTC is a trade that will benefit from his waning influence? Is it not the opposite?

love it